The Complete Guide to PTPTN Loan in Malaysia

How to apply for PTPTN loan and what are the requirements? More on PTPTN loan amount, interest rate and scholarship waiver for first class honour in this guide.

Education is without a doubt the most powerful investment you can make for your future.

If you have big dreams but find yourself with limited financial resources, there's always a way to fund your university degree through scholarships and study loans. And one of the most accessible study loans in Malaysia is the PTPTN loan that's aimed to support Malaysian students in furthering their education beyond secondary school.

Here's a comprehensive guide to help you understand what PTPTN is about, how you can apply for the loan and what are some of the things you need to watch out for.

#1. What is PTPTN?

PTPTN stands for Perbadanan Tabung Pendidikan Tinggi Nasional (or National Higher Education Fund Corporation), and is a government institution that offers study loans specifically for tertiary education for Malaysian students.

PTPTN loan is one of the top choices for students looking for education loans, given its relatively low interest rate. In addition, if you achieve a First Class Honours for your Degree, your loan could be converted into a scholarship, where you will be exempted from paying back the loan!

#2. Are you eligible for PTPTN?

In order to be eligible for the PTPTN loan, you must check all the following boxes:

- You are a Malaysian citizen

- You are aged 45 years and below (which means mature students are eligible too!)

- The monthly (gross) income of parents or guardians does not exceed RM50,000 (after deducting RM250 per dependent)

- You must already have an offer to study at an institution of higher learning (both public and private institutions, including colleges, universities and polytechnics, are accepted)

- The course that you are pursuing is approved and accredited by MQA

- The remaining period of your study must not be less than one year

- You have no other sponsors

- You must have an SSPN-i savings account with 15 digits before sending in your application

#3. What courses are eligible for PTPTN loan?

Not all courses are automatically eligible for PTPTN loan. The course that you intend to study must fulfil BOTH the following criteria. Otherwise, you will risk having to fund your entire education yourself.

Not all courses are automatically eligible for PTPTN loan. The course that you intend to study must fulfil BOTH the following criteria. Otherwise, you will risk having to fund your entire education yourself.

Criteria #1: Only certain qualifications are eligible, and at certain institutions

Qualifications that are eligible include Diploma and Degree. You have the option of choosing either private or public institutions.

If you are looking to study Professional Courses (e.g. ACCA, ICAEW) or Postgraduate Studies (e.g. Masters, PhD), only public institutions are eligible for PTPTN loans.

How about Pre-University courses, such as A-Level, Australian Matriculation and Canadian Pre-University? Well, these are all not eligible for PTPTN loans.

Here’s a summary table for your reference:

| Education Level | Private Institutions (IPTS) | Public Institutions (IPTA) |

|---|---|---|

| Pre-University (e.g. A-Level) | ✗ | ✗ |

| Foundation | ✓* | ✗ |

| Diploma (full-time and part-time) | ✓** | ✓ |

| Degree (full-time and part-time) | ✓** | ✓ |

| Postgraduate (Masters, PhD) (full-time and part-time) | ✗ | ✓ |

| Professional Courses (e.g. ACCA) (full-time and part-time) | ✗ | ✓ |

*Foundation courses at private institutions are only eligible for PTPTN loans if they are at the following universities:

- Multimedia University (MMU)

- Universiti Tenaga Nasional (UNITEN)

- Universiti Teknologi Petronas (UTP)

- Universiti Tun Abdul Razak (UNIRAZAK)

- UNITAR International University (UNITAR)

On the other hand, PTPTN loans for part-time courses** in private institutions are only eligible at these following universities:

- Open University Malaysia (OUM)

- Wawasan Open University

- Asia E University (AeU)

- UNITAR International University (UNITAR)

- Universiti Tun Abdul Razak (UNIRAZAK)

Criteria #2: Only MQA-accredited programmes are eligible

The second criteria is that the course that you are pursuing must be accredited by MQA.

MQA (which stands for Malaysian Qualifications Agency) is a government body that accredits academic programmes. Essentially, they ensure the quality and standards of tertiary education qualifications in Malaysia.

If you are planning to take up a PTPTN loan, make sure you refer to MQA’s website to confirm that your course has been either fully accredited or at least provisionally accredited.

#4. How much can you borrow from PTPTN?

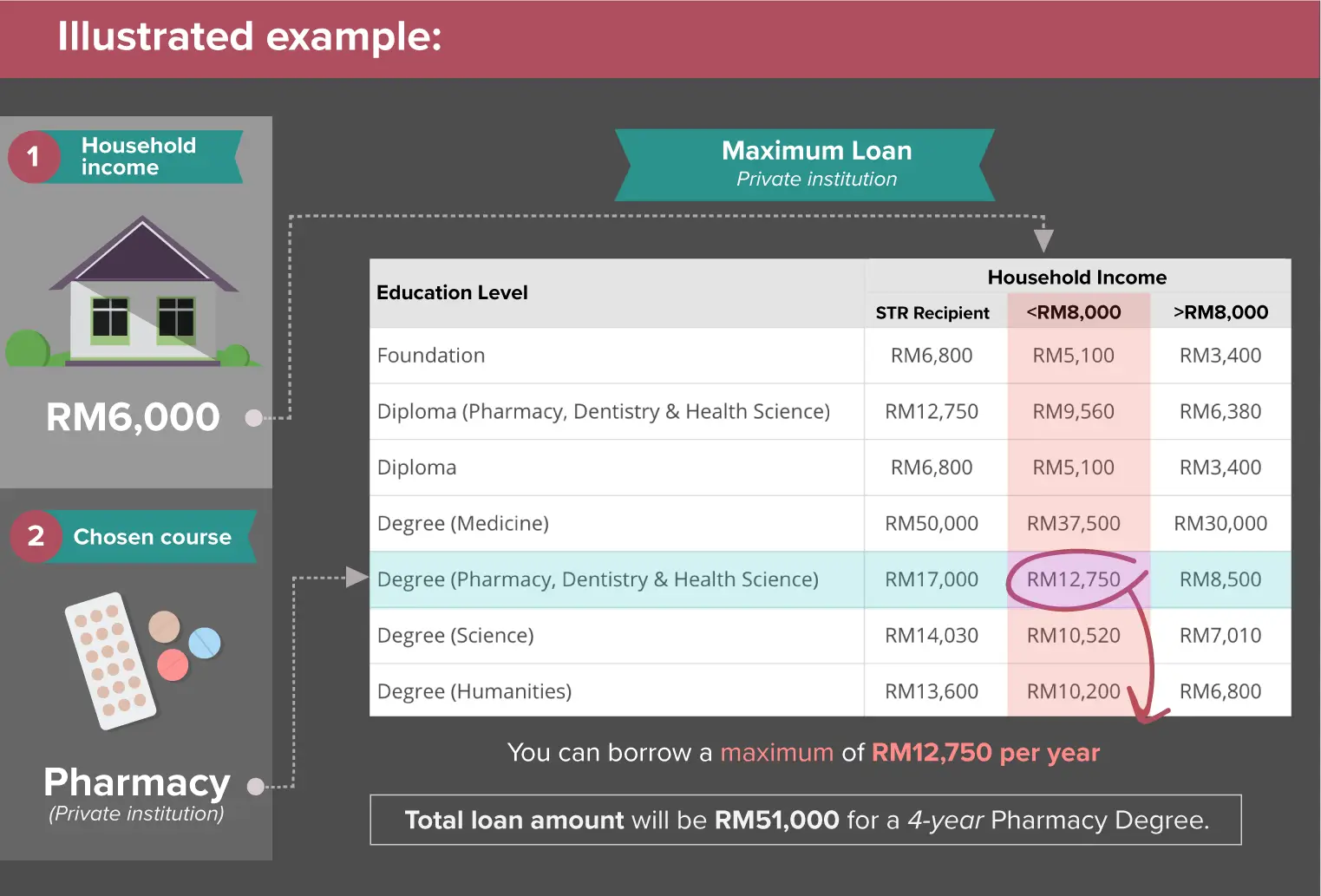

In an ideal world, you would be able to borrow as much as you needed, but unfortunately, this is not the case for PTPTN. Your PTPTN loan amount will depend on three things: (1) your household income, (2) the type of institution you are attending and (3) the course you are pursuing.

PTPTN loans are needs-based, which means:

- Lower-income families will be able to borrow a larger amount

- Loans for private institutions are higher compared to public institutions since the tuition fees are typically higher

- Science-related courses have higher loan amounts compared to humanities courses

Here is a summary of the loan amounts, quoted on a per-year basis:

Private Institutions

| Education Level | Household Income | ||

| STR Recipient | <RM8,000 | >RM8,000 | |

| Foundation | RM6,800 | RM5,100 | RM3,400 |

| Diploma (Pharmacy, Dentistry & Health Science) | RM12,750 | RM9,560 | RM6,380 |

| Diploma | RM6,800 - 8,000* | RM5,100 | RM3,400 |

| Degree (Medicine) | RM50,000 | RM37,500 | RM30,000 |

| Degree (Pharmacy, Dentistry & Health Science) | RM17,000 | RM12,750 | RM8,500 |

| Degree (Science) | RM14,030 | RM10,520 | RM7,010 |

| Degree (Humanities) | RM13,600 | RM10,200 | RM6,800 |

| Postgraduate (Masters, PhD) | N/A | ||

| Professional Courses (e.g. ACCA) | |||

*The Ministry of Higher Education has increased the PTPTN loan from RM6,800 to RM8,000 for STR (Sumbangan Tunai Rahmah) recipients. However, this loan is only applicable in selected private institutions that sign up for the simpanan bertakaful initiative with SSPN-i Plus. Students who are eligible for this loan will also receive RM30 (or more depending on the student's household income) credited into their SSPN-i Plus monthly throughout their studies by the private institution.

Public Institutions

| Education Level | Household Income | ||

| STR Recipient | <RM8,000 | >RM8,000 | |

| Degree (Humanities) | RM6,180 | RM4,630 | RM3,090 |

| Degree (Science) | RM6,650 | RM4,990 | RM3,330 |

| Degree (Medicine) | N/A | ||

| Degree (Pharmacy, Dentistry & Health Science) | |||

| Diploma (Pharmacy, Dentistry & Health Science) | |||

| Integration / Diploma | RM4,750 | RM3,560 | RM2,380 |

| Foundation | N/A | ||

| Postgraduate (Master's Degree) | RM9,500 | RM7,130 | RM4,750 |

| Postgraduate (PhD) | RM24,700 | RM18,530 | RM12,350 |

| Professional Courses (e.g. ACCA) | RM5,700 | RM4,280 | RM2,850 |

So, let’s say your total household income is RM6,000 (Bracket B) and you intend to study for a Degree in Pharmacy at a Private Institution. You will be eligible to borrow a maximum of RM12,750 per year (refer to Column B1), or a total loan amount of RM51,000 for a 4-year Pharmacy Degree.

Remember that securing a PTPTN loan doesn’t mean that all your financial woes are over. Your loan may only cover part of your tuition fees, so make sure you do the math beforehand to avoid any surprises!

Remember that securing a PTPTN loan doesn’t mean that all your financial woes are over. Your loan may only cover part of your tuition fees, so make sure you do the math beforehand to avoid any surprises!

#5. What are the steps to apply for a PTPTN loan?

Before you begin to apply for a PTPTN loan, make sure you have an offer letter from the university, as it is part of the loan application process.

Step 1: Open a savings account with the university's panel bank

You will first need to open a savings account with a specific bank based on your university. To find out the correct panel bank, refer to the PTPTN website here.

Step 2: Download the myPTPTN app

Next, download the myPTPTN app from Google Play or Apple App Store. You will be prompted to register for an account. As part of the process, you'll need your IC, a valid phone number and an email address. You will also need to conduct an identity verification via the app.

Step 3: Open an SSPN account

Through the myPTPTN app, open an SSPN account by depositing RM20. This account is necessary for PTPTN loan applications.

Note that the SSPN account is a savings scheme by PTPTN specifically for higher education, and is separate from your regular savings account.

Step 4: Purchase a PTPTN PIN number

To proceed, you'll need to purchase a PTPTN PIN number. This can be done through the myPTPTN website under the Pendaftaran Permohonan Pinjaman option. It will cost you RM5.

Step 5: Complete the application form

Thereafter, complete the loan application form on the myPTPTN website. Make sure to fill in all required details carefully.

Step 6: Receive your loan payments

Once your loan application has been approved, your PTPTN loan will be disbursed based on a predetermined schedule, depending on the programme you have applied for.

#6. What do you need to know when applying for PTPTN loan?

We’ve covered quite a lot of ground, but here are some additional items that you need to take note of when it comes to taking up a study loan from PTPTN.

1) You need at least a GPA of 2.0 to maintain your PTPTN loan

To ensure that you continuously receive funds from PTPTN during your studies, you must ensure that you achieve at least GPA of 2.0 at all times.

If at any time your GPA is less than 2.0, you will not receive PTPTN funds for that particular semester. If your grades improve in the subsequent semester and you raise your GPA to above 2.0, your loan disbursements will be reinstated.

2) There is an interest rate of 1% for your PTPTN loan

PTPTN loans are subject to a flat rate interest of 1% (or ujrah, a syariah-compliant “fee” to help with the administrative and management costs of PTPTN).

Here's an example of how your interest is calculated:

| Total Loan Amount | RM50,000 |

|---|---|

| Repayment Period | 15 years |

| Interest Rate Per Annum | 1% |

| Interest Amount | RM50,000 x 1% x 15 years = RM7,500, or RM41.67 per month |

| Total Monthly Repayment | (RM50,000 + RM7,500) / 15 years = RM319.44 per month |

Based on the example above, the interest you pay each month on your PTPTN loan is only RM41.67, which is extremely low compared to loans offered by banks and credit facilities.

If you settle your entire loan amount within 12 months after completing your studies, you will not incur the 1% interest / ujrah. This means you only need to pay back what you borrowed, without any interest!

3) You need to start paying back PTPTN 12 months after graduating

Your repayment period starts 12 months after you complete your studies.

PTPTN will not be sending you any instruction letters, so do be responsible about paying your study loan based on your repayment schedule.

The loan repayment period will depend on how much you borrowed. Here is an indicative summary table.

| Total Loan Amount | Loan Repayment Period | Estimated Repayment (incl. interest) |

|---|---|---|

| Less than RM10,000 | 5 years | Less than RM175 per month |

| RM10,000 to RM22,000 | 10 years | RM92 to RM202 per month |

| RM22,000 to RM50,000 | 15 years | RM140 to RM319 per month |

| More than RM50,000 | 20 years | RM250 to RM750 per month |

Do not worry if you are facing difficulties with making repayments as PTPTN is always open for negotiations to restructure your loan repayment. Just head to the nearest PTPTN branch to negotiate for a more favourable repayment rate.

4) Not paying back your PTPTN loan may have serious consequences!

The rise of PTPTN defaulters (people who fail to pay up their loans) over the past few years has resulted in the government imposing a series of measures to deter borrowers from defaulting.

Although some of these measures like the travel ban have been lifted, the blacklisting of PTPTN defaulters in the Central Credit Reference Information System (CCRIS) is still ongoing. CCRIS is a system that stores financial information on Malaysian borrowers and is used by banks to determine if you are a good or bad borrower.

Being blacklisted on CCRIS is a serious matter, as this could mean that you will likely be rejected immediately whenever you apply for credit cards, home loans or personal loans. As such, it is crucial that you do not default on your PTPTN loan.

5) Your PTPTN loan can be converted into a scholarship

If you complete your Degree with First Class Honours, you will be exempted from paying back your PTPTN loan, which means you essentially received a full scholarship!

Do note however that First Class Honours may differ from university to university, so make sure you check with your counsellors so that you know what to aim for. Generally, however, First Class Honours typically requires you to have at least CGPA of 3.67/4.00, or higher.

#7. Frequently Asked Questions (FAQ)

1) If I have applied for PTPTN loan for Diploma, can I still apply for PTPTN loan for Degree later on?

Yes, you can. If you would like to continue studying at a higher level, you may choose to defer your loan repayment. The deferment is given automatically when you apply for another loan, and you will only start incurring interest on both loans after completing your degree.

2) Can I apply for PTPTN for my second degree?

You can only appy for PTPTN for your second degree if you did not apply for PTPTN for your first degree. If you already borrowed PTPTN for your first degree, you must settle the loan for your first degree before you can apply for another PTPTN loan again.

3) Does PTPTN cover my degree if I study overseas?

No, PTPTN does not cover overseas programmes.

4) I'm planning to do a twinning programme with an overseas university. Does PTPTN cover my degree?

PTPTN will only cover your cost of study in Malaysia. You will need to find a different source of funding when you transfer overseas.